"I think I'll have a shave, then buy myself a tuxedo and top hat."

George theorized that the inequity of society could be alleviated through a single tax - a tax on land. Those who owned land had a tremendous advantage over those who did not, as they could subsist off their rents without actually doing any work; his tax system eliminated this unequal power relationship by making it disadvantageous for a few people to hold all the land. His ideas have had little luck being implemented, though some Eastern European countries have experimented with higher land taxes to discourage absentee landowners. Much like the flat tax, maligned by myself in this very blog, Hong Kong seems to be the only place that has made George's system work at all, imposing high land taxes to keep taxes on income low.

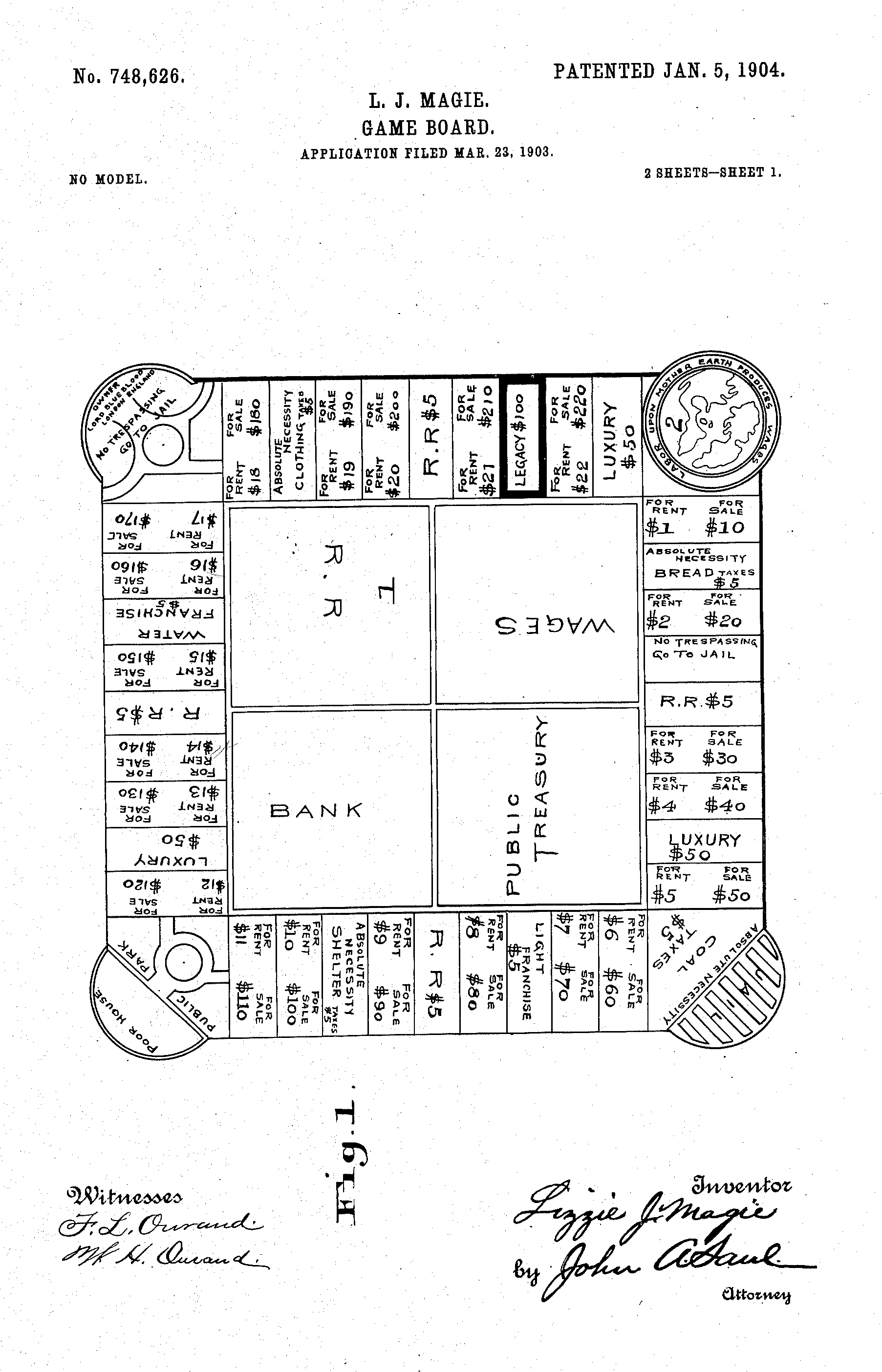

Besides his innovative ideas, George was also known for his rabidly dedicated followers. One such person was Elizabeth Magie, who in 1903 devised a game to teach the principles of Georgism. She called it "The Landlord's Game," and as she described it, "The object of this game is not only to afford amusement to players, but to illustrate to them how, under the present or prevailing system to land tenure, the landlord has an advantage over other enterprisers, and also how the single tax would discourage speculation."

Magie acquired a patent for her game in 1904, but it was not manufactured until 1910, which is when the streets and landmarks were added, though these were mostly taken from Chicago and New York, not Atlantic City. By then, the rules more closely resembled the modern game, but Magie intended that each roll of the dice be seen not as an investment opportunity, but a rent obligation. Trespassing on "Lord Blue Blood's Estate" will land one in prison, while a failure to pay a rent will put you in the poorhouse. And the ubiquitous "Go" was instead an exaltation of labor: "Labor Upon Mother Earth Produces Wages."

The game clearly looks like what we all know as today's "Monopoly," but the evolution from "The Landlord's Game" to the game allegedly created by Charles Darrow in 1935 is unclear. That year, Parker Brothers bought the rights to Magie's game for $500 in order to eliminate any competing claims to ownership of their new product. As part of the agreement, the company had to produce and market her original game alongside their new celebration of capitalism. To see the progression from Magie's game to Monopoly, see here, which includes complete game boards and rules for each version; also, check out University of Alabama law professor Alfred Brophy's blog entry on the subject.

I have contacted a few "Monopoly" collectors in an effort to find some version of "The Landlord's Game," but they told me that copies are extremely rare and only come up for auction on occasion. There are no known reproductions of the game since it was discontinued in 1939, but luckily, we do have complete rules and boards for nearly every version of the game, so I think I will make my own, and I would encourage you to do the same. The original rules are here, the first game board here, along with all the necessary pieces (which you will have to make yourself, and you may have trouble finding the various game cards), or you can try your hand at the 1910, 1924, or 1939 versions.

I have contacted a few "Monopoly" collectors in an effort to find some version of "The Landlord's Game," but they told me that copies are extremely rare and only come up for auction on occasion. There are no known reproductions of the game since it was discontinued in 1939, but luckily, we do have complete rules and boards for nearly every version of the game, so I think I will make my own, and I would encourage you to do the same. The original rules are here, the first game board here, along with all the necessary pieces (which you will have to make yourself, and you may have trouble finding the various game cards), or you can try your hand at the 1910, 1924, or 1939 versions.If you are interested in learning more about Henry George's ideas, his adherents remain as dedicated as ever, maintaining the Henry George Institute, where many of his works are available online. If the robber baron ethic or socialist experimentation of the 1920's and 30's don't appeal to you, you can try your hand at another Monopoly-like game for the present day, the online "Bailout Game," in which you decide which banks get TARP money while trying to keep the Dow up and recession at bay.

UPDATE: In my search for an original copy of "The Landlord's Game," I stumbled across the website of Dr. Ralph Anspach, the creator of yet another Monopoly-type game, "Anti-Monopoly" (which is still available online). Introduced in 1974, Anspach went through a lengthy legal battle with Parker Brothers, eventually winning the right to sell his own game, which starts "where Monopoly ends. The board is monopolized in the beginning of the game and players compete with each other to return this virtual economy back to a competitive, free enterprise system."

He has also created and sold "The Original Monopoly Game," which is based on Magie's original game, but also encourages the popular folk tradition of the game. Before "Monopoly" gained, well, a monopoly over this style of game, it was a popular homemade game in which players would write in the names of the streets and landmarks in their own town and customize the rules. Anspach's version tries to recapture this period of the game's history, but unfortunately, it is no longer being produced.